Background

The main aim of this post is to show how the Seaborn package can be used to simplify visualisation of statistical data.

The data and its corresponding visualisations tell a very important story, but this time I will desist from directly commenting on, or interpreting the story being told by the data, as this is a highly emotive subject.

Dataset

This dataset is a derivative of Reinhart et. al’s Global Financial Stability dataset which can be found online at: https://www.hbs.edu/behavioral-finance-and-financial-stability/data/Pages/global.aspx

The dataset will be valuable to those who seek to understand the dynamics of financial stability within the African context.

Context

The dataset specifically focuses on the Banking, Debt, Financial, Inflation and Systemic Crises that occurred, from 1860 to 2014, in 13 African countries, including: Algeria, Angola, Central African Republic, Ivory Coast, Egypt, Kenya, Mauritius, Morocco, Nigeria, South Africa, Tunisia, Zambia and Zimbabwe.

Acknowledgements

-

Kaggle Dataset (22 Nov 2019)

- Reinhart, C., Rogoff, K., Trebesch, C. and Reinhart, V. (2019) Global Crises Data by Country. [online] https://www.hbs.edu/behavioral-finance-and-financial-stability/data. Available at: https://www.hbs.edu/behavioral-finance-and-financial-stability/data/Pages/global.aspx [Accessed: 17 July 2019].

-

Kaggle kernel (22 Nov 2019)

Now, without further adieu…

Import Relevant Libraries

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from pandas.plotting import register_matplotlib_converters

register_matplotlib_converters()

import seaborn as sns

sns.set('notebook')

sns.set_style('darkgrid')

Load data

raw = pd.read_csv('african_crises.csv', index_col='year', parse_dates=True)

display(raw.info())

raw.sample(3)

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 1059 entries, 1870-01-01 to 2013-01-01

Data columns (total 13 columns):

case 1059 non-null int64

cc3 1059 non-null object

country 1059 non-null object

systemic_crisis 1059 non-null int64

exch_usd 1059 non-null float64

domestic_debt_in_default 1059 non-null int64

sovereign_external_debt_default 1059 non-null int64

gdp_weighted_default 1059 non-null float64

inflation_annual_cpi 1059 non-null float64

independence 1059 non-null int64

currency_crises 1059 non-null int64

inflation_crises 1059 non-null int64

banking_crisis 1059 non-null object

dtypes: float64(3), int64(7), object(3)

memory usage: 115.8+ KB

None

| case | cc3 | country | systemic_crisis | exch_usd | domestic_debt_in_default | sovereign_external_debt_default | gdp_weighted_default | inflation_annual_cpi | independence | currency_crises | inflation_crises | banking_crisis | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| year | |||||||||||||

| 1955-01-01 | 69 | ZMB | Zambia | 0 | 0.000714 | 0 | 0 | 0.0 | 3.571429 | 0 | 0 | 0 | no_crisis |

| 1984-01-01 | 35 | KEN | Kenya | 0 | 15.781300 | 0 | 0 | 0.0 | 20.667000 | 1 | 0 | 1 | no_crisis |

| 2001-01-01 | 56 | ZAF | South Africa | 0 | 12.126500 | 0 | 0 | 0.0 | 5.700000 | 1 | 1 | 0 | no_crisis |

- No missing data :)

- Mostly numerical data

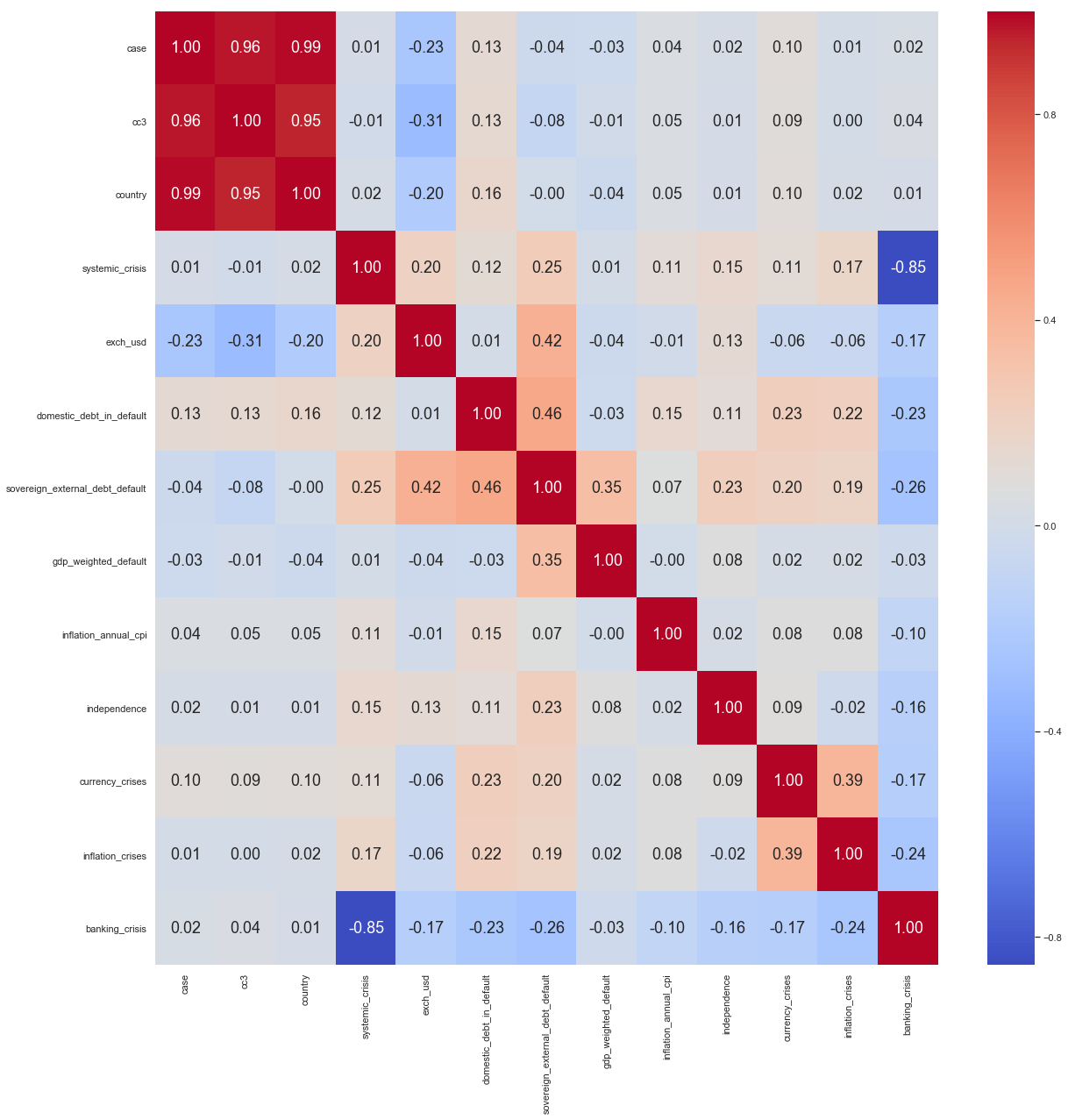

Correlation Matrix

LabelEncoder

Let’s see if any of the features are correlated:

- Let’s first convert the non-numerical columns to numerical.

Enter: labelEncoder

numerical = raw.copy() # first, copy our raw dataframe

from sklearn.preprocessing import LabelEncoder

num = LabelEncoder()

numerical.cc3 = num.fit_transform(numerical.cc3)

numerical.country = num.fit_transform(numerical.country)

numerical.banking_crisis = num.fit_transform(numerical.banking_crisis)

numerical.head()

| case | cc3 | country | systemic_crisis | exch_usd | domestic_debt_in_default | sovereign_external_debt_default | gdp_weighted_default | inflation_annual_cpi | independence | currency_crises | inflation_crises | banking_crisis | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| year | |||||||||||||

| 1870-01-01 | 1 | 3 | 0 | 1 | 0.052264 | 0 | 0 | 0.0 | 3.441456 | 0 | 0 | 0 | 0 |

| 1871-01-01 | 1 | 3 | 0 | 0 | 0.052798 | 0 | 0 | 0.0 | 14.149140 | 0 | 0 | 0 | 1 |

| 1872-01-01 | 1 | 3 | 0 | 0 | 0.052274 | 0 | 0 | 0.0 | -3.718593 | 0 | 0 | 0 | 1 |

| 1873-01-01 | 1 | 3 | 0 | 0 | 0.051680 | 0 | 0 | 0.0 | 11.203897 | 0 | 0 | 0 | 1 |

| 1874-01-01 | 1 | 3 | 0 | 0 | 0.051308 | 0 | 0 | 0.0 | -3.848561 | 0 | 0 | 0 | 1 |

Correlation

corr = numerical.corr()

corr

| case | cc3 | country | systemic_crisis | exch_usd | domestic_debt_in_default | sovereign_external_debt_default | gdp_weighted_default | inflation_annual_cpi | independence | currency_crises | inflation_crises | banking_crisis | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| case | 1.000000 | 0.964105 | 0.990553 | 0.010991 | -0.231976 | 0.128358 | -0.039262 | -0.032981 | 0.044762 | 0.021858 | 0.095339 | 0.006405 | 0.023652 |

| cc3 | 0.964105 | 1.000000 | 0.946147 | -0.012692 | -0.312222 | 0.134268 | -0.082447 | -0.007799 | 0.048917 | 0.012709 | 0.090759 | 0.003644 | 0.041981 |

| country | 0.990553 | 0.946147 | 1.000000 | 0.015586 | -0.198953 | 0.155659 | -0.000455 | -0.041843 | 0.049184 | 0.013308 | 0.097166 | 0.016491 | 0.014667 |

| systemic_crisis | 0.010991 | -0.012692 | 0.015586 | 1.000000 | 0.202687 | 0.122158 | 0.249850 | 0.005274 | 0.106452 | 0.147083 | 0.112751 | 0.172562 | -0.853702 |

| exch_usd | -0.231976 | -0.312222 | -0.198953 | 0.202687 | 1.000000 | 0.005253 | 0.422890 | -0.040726 | -0.011947 | 0.126034 | -0.056472 | -0.063783 | -0.168775 |

| domestic_debt_in_default | 0.128358 | 0.134268 | 0.155659 | 0.122158 | 0.005253 | 1.000000 | 0.464751 | -0.029874 | 0.151832 | 0.109120 | 0.227585 | 0.224429 | -0.225797 |

| sovereign_external_debt_default | -0.039262 | -0.082447 | -0.000455 | 0.249850 | 0.422890 | 0.464751 | 1.000000 | 0.345919 | 0.072609 | 0.228192 | 0.199428 | 0.187930 | -0.263992 |

| gdp_weighted_default | -0.032981 | -0.007799 | -0.041843 | 0.005274 | -0.040726 | -0.029874 | 0.345919 | 1.000000 | -0.004535 | 0.078936 | 0.016970 | 0.017630 | -0.026545 |

| inflation_annual_cpi | 0.044762 | 0.048917 | 0.049184 | 0.106452 | -0.011947 | 0.151832 | 0.072609 | -0.004535 | 1.000000 | 0.016569 | 0.076590 | 0.080060 | -0.098860 |

| independence | 0.021858 | 0.012709 | 0.013308 | 0.147083 | 0.126034 | 0.109120 | 0.228192 | 0.078936 | 0.016569 | 1.000000 | 0.086376 | -0.022548 | -0.159620 |

| currency_crises | 0.095339 | 0.090759 | 0.097166 | 0.112751 | -0.056472 | 0.227585 | 0.199428 | 0.016970 | 0.076590 | 0.086376 | 1.000000 | 0.393376 | -0.166859 |

| inflation_crises | 0.006405 | 0.003644 | 0.016491 | 0.172562 | -0.063783 | 0.224429 | 0.187930 | 0.017630 | 0.080060 | -0.022548 | 0.393376 | 1.000000 | -0.235852 |

| banking_crisis | 0.023652 | 0.041981 | 0.014667 | -0.853702 | -0.168775 | -0.225797 | -0.263992 | -0.026545 | -0.098860 | -0.159620 | -0.166859 | -0.235852 | 1.000000 |

Matrix

Let’s invoke a heatmap for better visualisation of the correlations. This is a correlation matrix:

plt.figure(figsize=(20,20))

sns.heatmap(corr, cmap='coolwarm',annot=True, fmt='.2f', annot_kws={'size' : 18})

<matplotlib.axes._subplots.AxesSubplot at 0x1120cc240>

We see that the first 3 columns are highly correlated with each other. This is simply because they contain the same information. We will thus have to drop two and keep one as an identifier for country. For visualisation purposes, we will need the country name.

- Drop

caseandcc3as they contain same information ascountry - Textual data:

Country nameandbanking crisis: y/n.

However, when it comes to predictive analysis, we will have to either encode the country column, or instead use the case column, as it is already numerical!

For now, we go back to the raw variable, drop the case and cc3 columns and perform more EDA.

raw.drop(raw.loc[:,'case' : 'cc3'], axis=1, inplace=True)

Trends

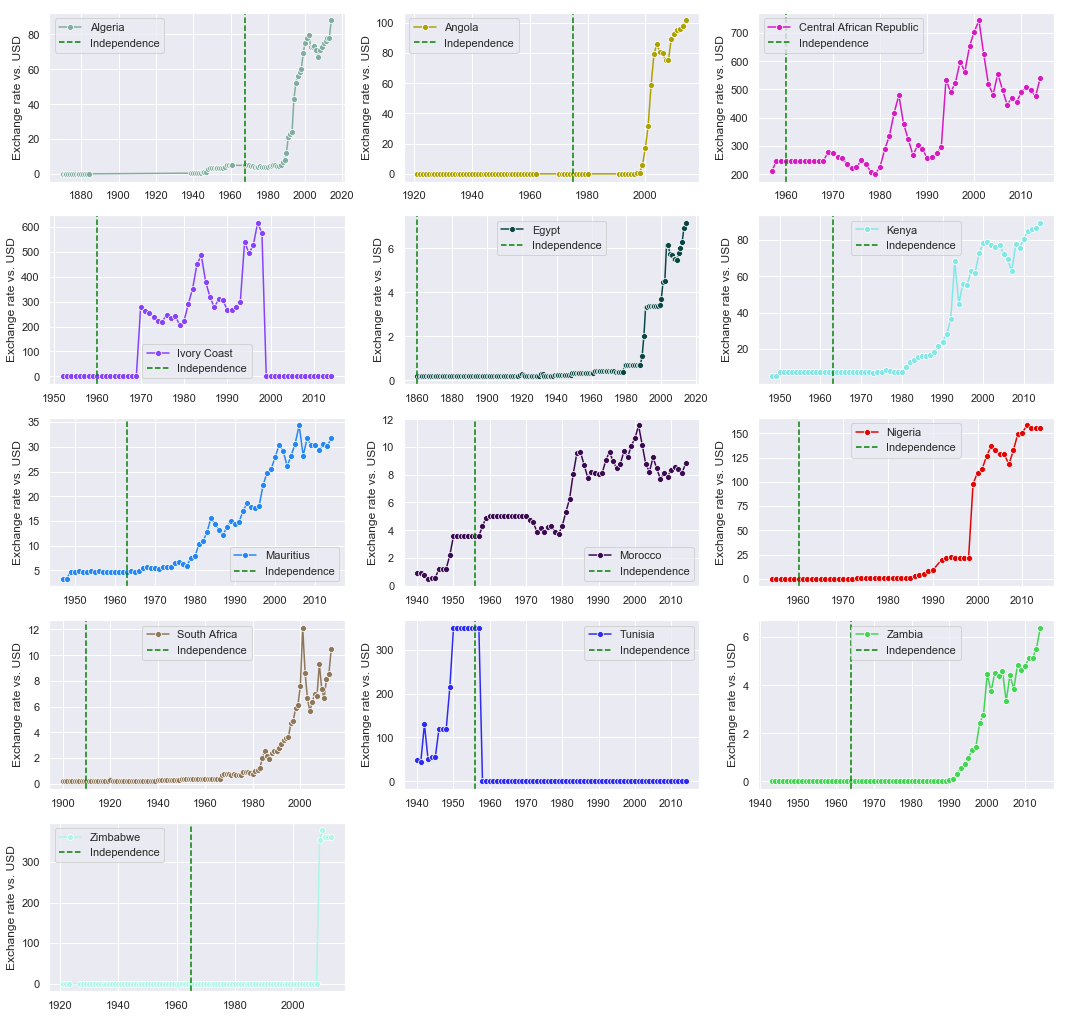

Exchange Rate vs. USD

The USD is a standard unit of comparison for a currency’s strength. We start by observing patterns, overtime, in each country’s currency exchange rate to the dollar

countries = raw.country.unique() # List of countries in the dataset

plt.figure(figsize=(18,18)) # create empty figure with these dimensions

plt.title('Currency exchange rate vs. USD over time') # title the plots

for ind, country in enumerate(countries): #index, country

plt.subplot(5,3,ind+1) # add a plot box in the figure for each country

exch = raw[raw.country==country].exch_usd # country's exchange rate to the dollar

sns.lineplot(data= exch, label=str(country), marker='o', color=np.random.rand(3,)) # plot the trend

plt.ylabel('Exchange rate vs. USD')

# when did the country gain independence?

independence = min(raw[raw.country==country].independence[raw[raw.country==country].independence==1].index)

plt.axvline(independence, color='green', linestyle="--", label='Independence')

plt.legend(loc='best')

plt.show()

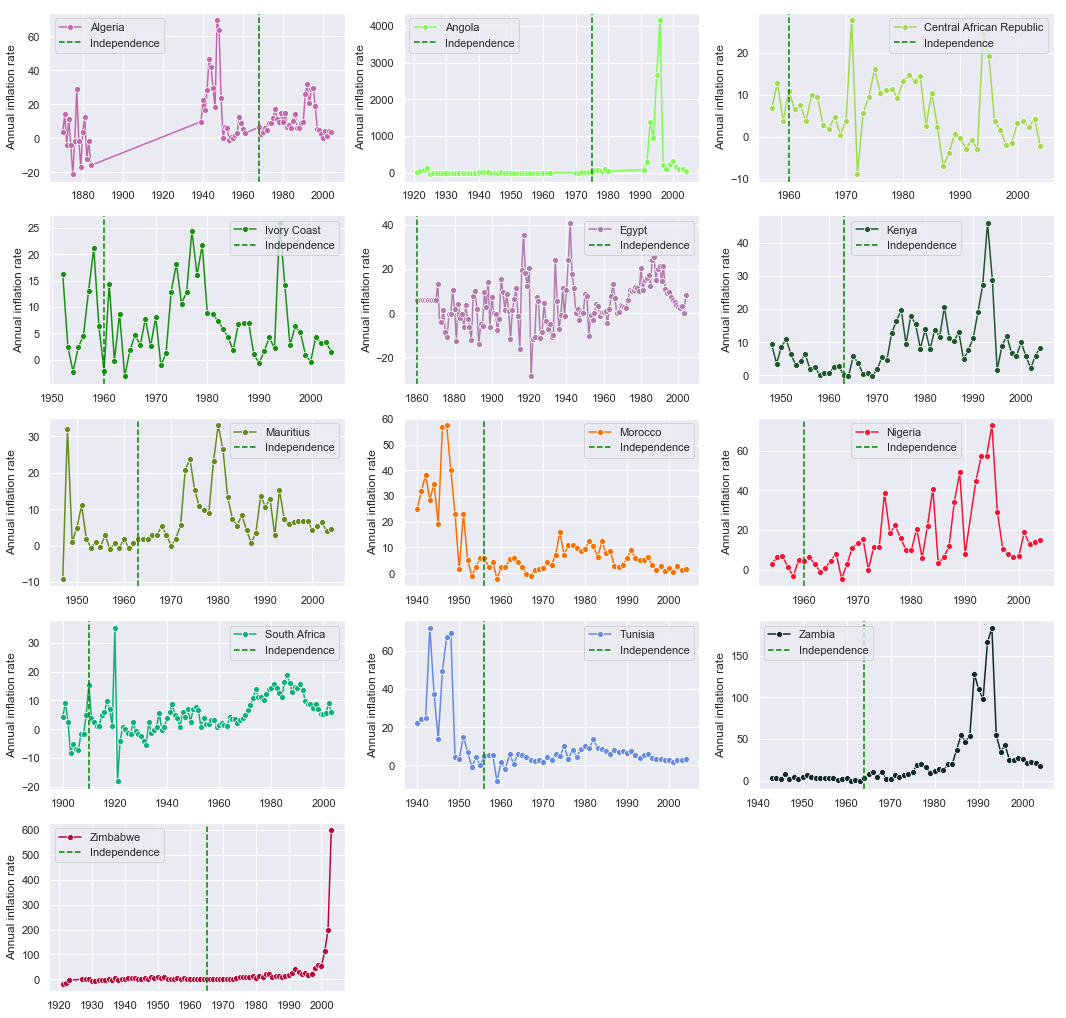

Inflation Rate

plt.figure(figsize=(18,18)) # create empty figure with these dimensions

plt.title('Annual inflation Rate') # title the plots

for ind, country in enumerate(countries): #index, country

plt.subplot(5,3,ind+1) # add a plot box in the figure for each country

infl = raw[raw.country==country].inflation_annual_cpi # country's exchange rate to the dollar

sns.lineplot(data= infl[0:-10], label=str(country), marker='o', color=np.random.rand(3,)) # plot the trend

plt.ylabel('Annual inflation rate')

# when did the country gain independence?

independence = min(raw[raw.country==country].independence[raw[raw.country==country].independence==1].index)

plt.axvline(independence, color='green', linestyle="--", label='Independence')

plt.legend(loc='best')

plt.show()

Average exchange rate vs. independence

plt.figure(figsize=(10,8))

rawn = raw.copy()

#rawn = rawn[rawn.gdp_weighted_default>0]

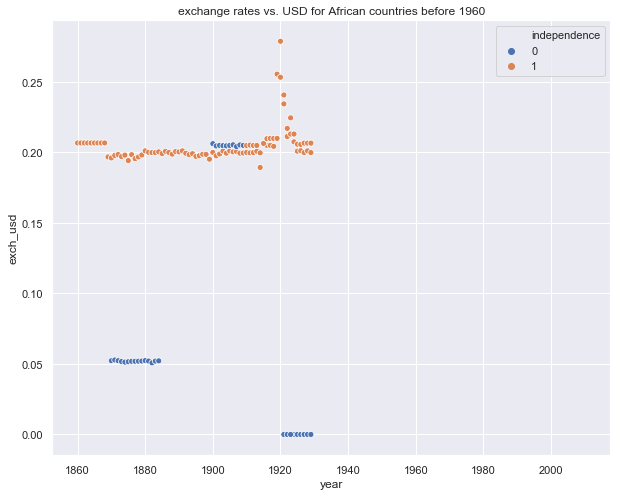

plt.title('exchange rates vs. USD for African countries before 1960')

rawn = rawn[rawn.index<'1930']

sns.scatterplot(x=rawn.index, y=rawn.exch_usd, hue=rawn.independence)

<matplotlib.axes._subplots.AxesSubplot at 0x1a2db26c50>

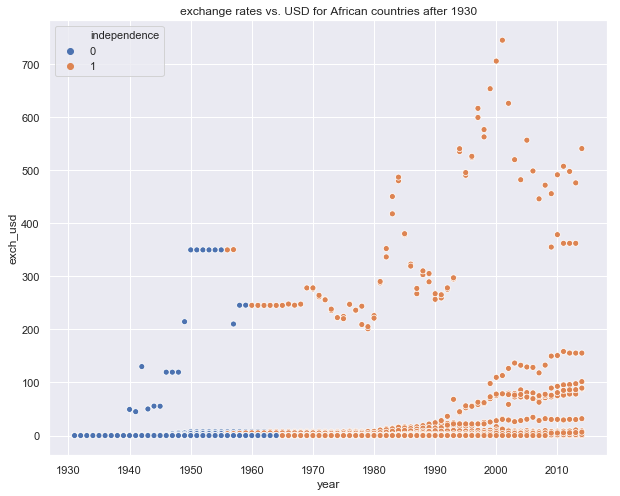

plt.figure(figsize=(10,8))

rawn = raw.copy()

#rawn = rawn[rawn.gdp_weighted_default>0]

plt.title('exchange rates vs. USD for African countries after 1930')

rawn = rawn[rawn.index>'1930']

sns.scatterplot(x=rawn.index, y=rawn.exch_usd, hue=rawn.independence)

<matplotlib.axes._subplots.AxesSubplot at 0x1a2c518c50>

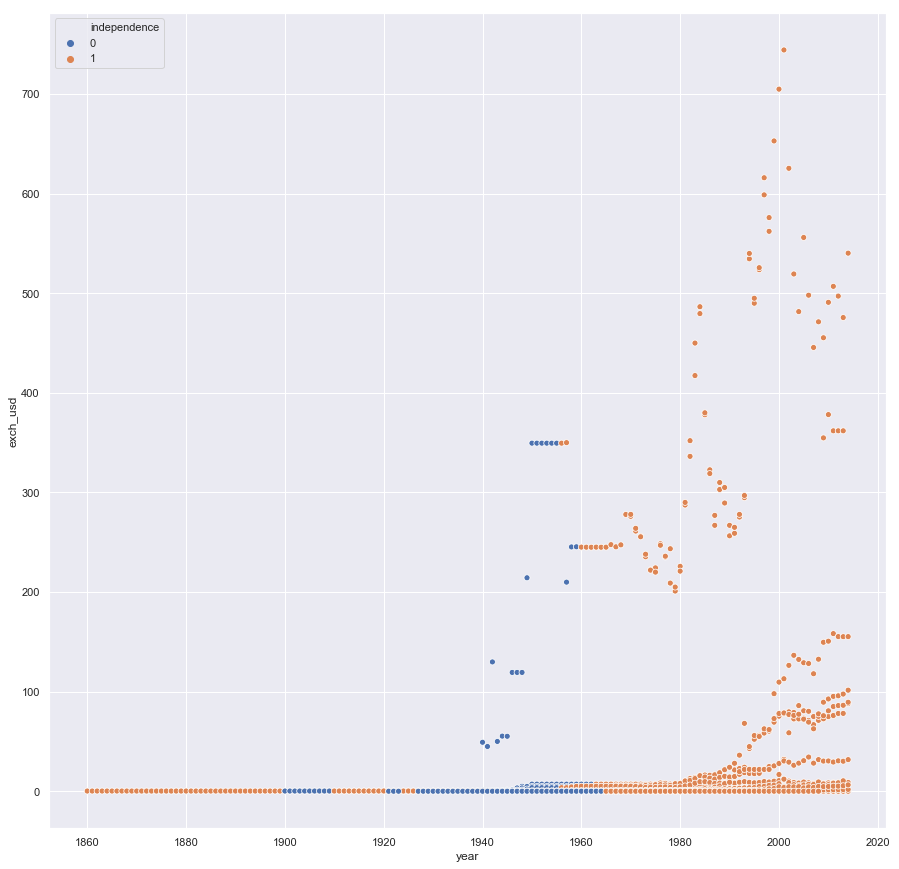

plt.figure(figsize=(15,15))

rawn = raw.copy()

#plt.title('exchange rates vs. USD for African countries 1860 - 2014')

sns.scatterplot(x=rawn.index, y=rawn.exch_usd, hue=rawn.independence)

plt.show()

In general, we see that the value of an African country’s currency, on average, plummetted after independence, which generally occurred in the middle of the 20th century

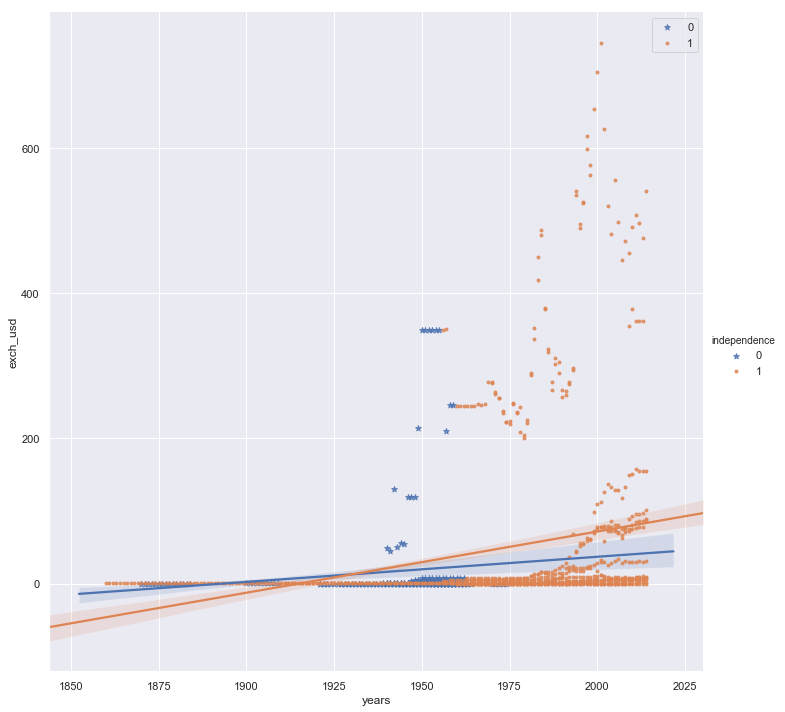

This is confirmed by the plot below, which shows a steeper rise in exchange rates after independence

rawn['years'] = [float(i) for i in rawn.index.year]

plt.figure(figsize=(60,40))

from matplotlib import rcParams

# figure size in inches

rcParams['figure.figsize'] = 21.7,40.27

sns.lmplot(x='years', y='exch_usd', hue='independence', data=rawn,

markers=['*', '.'], height=10, aspect=1) #)

plt.legend(loc='best')

plt.show()

<Figure size 4320x2880 with 0 Axes>

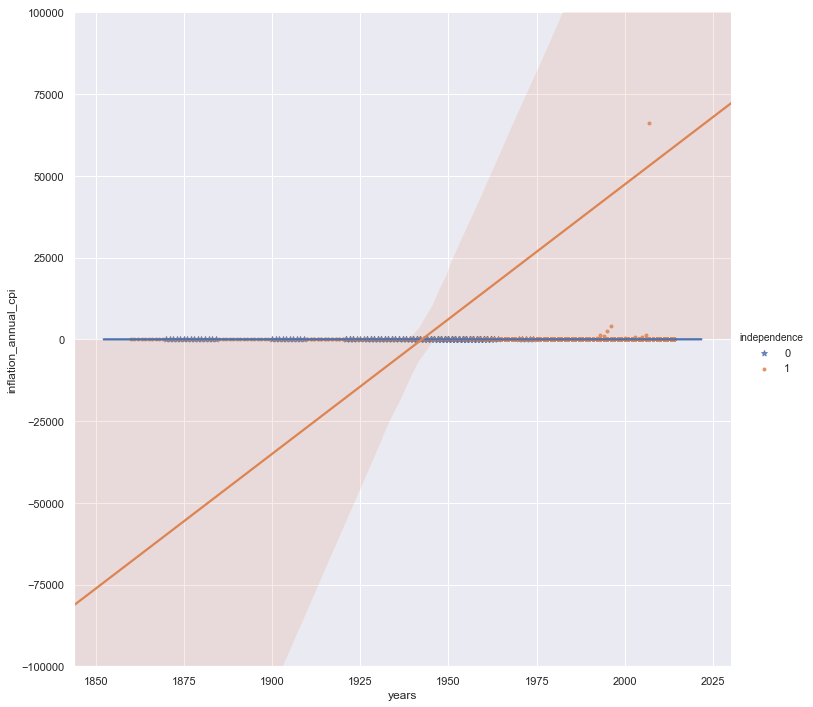

sns.lmplot(x='years', y='inflation_annual_cpi', hue='independence', data=rawn,

markers=['*', '.'], height=10, aspect=1) #)

plt.ylim(-100000, 100000)

plt.show()

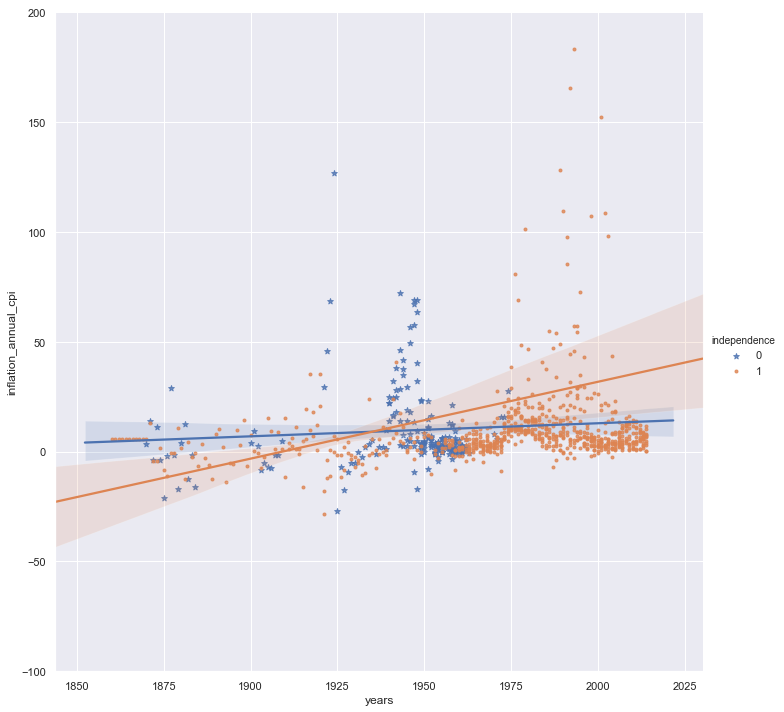

The annual inflation rates also illustrate this point. However, removing Zimbabwe from this analysis might yield a more sensible result:

rawz = rawn.copy()

rawz = rawz[rawz.country!='Zimbabwe']

sns.lmplot(x='years', y='inflation_annual_cpi', hue='independence', data=rawz,

markers=['*', '.'], height=10, aspect=1) #)

plt.ylim(-100, 200)

plt.show()

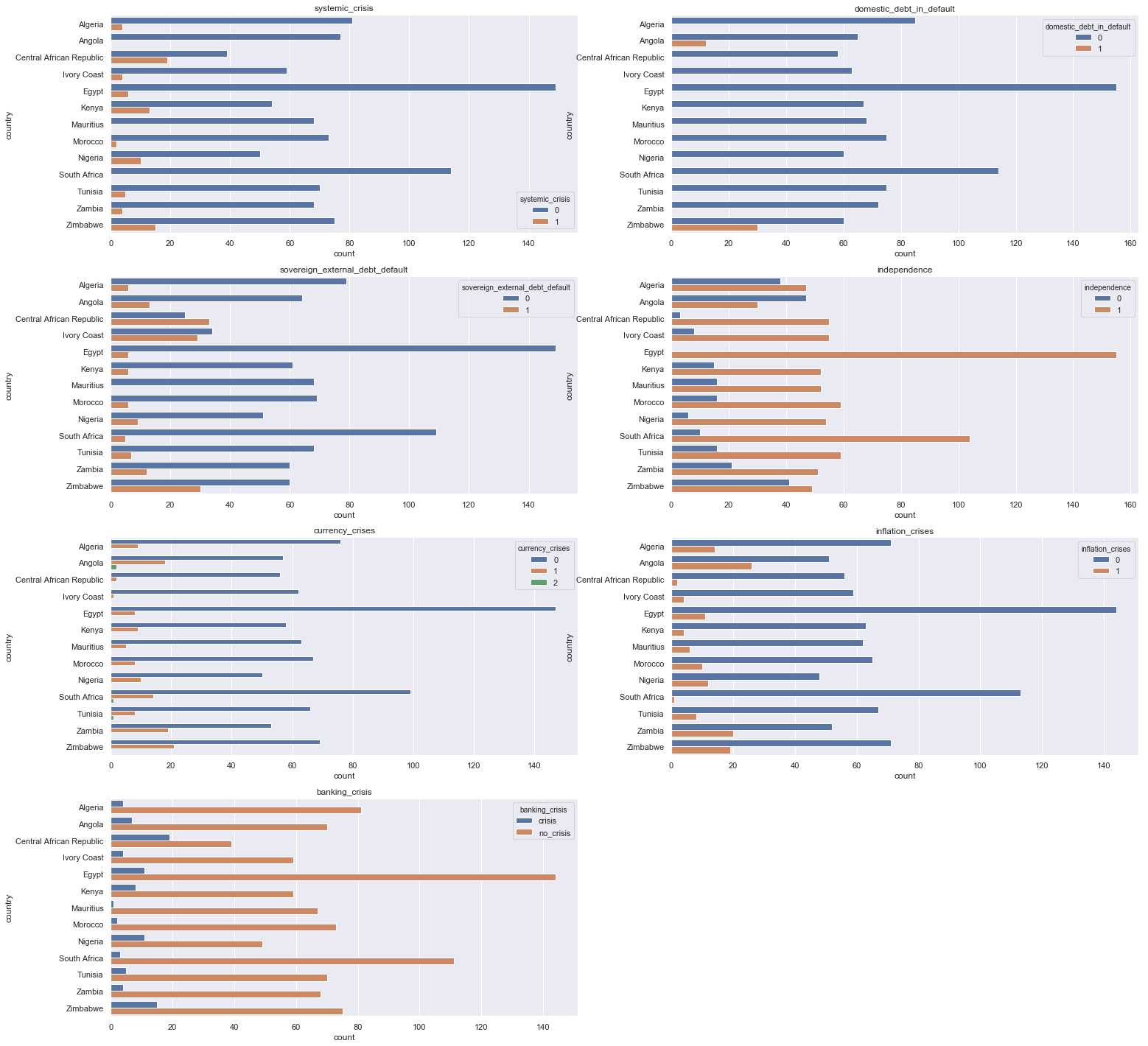

Crises and debt counts for each of the countries

counts = [raw.columns[i] for i,j in enumerate(raw.dtypes) if j in ['int64', 'O']][1:] # Non-continuous numerical columns (excluding Country)

plt.figure(figsize=(25,25))

plt.title('Debt and crises for each country')

for ind, count in enumerate(counts):

plt.subplot(4,2,ind+1) # add a plot box in the figure for each country

plt.title(count)

sns.countplot(y=raw.country, hue=raw[count])

plt.show()

That’s all for now. Thank you for the read!